What is Candlesticks patterns -

Candlesticks patterns are used to predict the future

direction of price movement. The most 16 common candlesticks patterns and use

of them to identify the opportunities while trading.

What is the candlestick

A candlestick is a way to display the information about an

asset’s price movement. It is one of the most popular components of technical

analysis and to catch the price action on the movement.

The candlesticks have three basic features :

- The body, which represents the

open-to-close range

- The wick. Or shadow, that

indicates the intraday high and low

- The colour, which reveals the

direction of stock movement basically green body indicates a price

increase and red body shows a price decrease.

Before

you start trading, its important to familiarize yourself with the basics of

candlestick and the only way to understand is “PRACTISE READING CANDLESTICK

PATTERNS”.

The best way to learn to read candlestick patterns is to practice

entering and exiting trades from the signals they give. You can develop your

skills in Demat – trading account, you may open by clicking below:

https://zerodha.com/?c=AY8398&s=CONSOLE

Six bullish

candlestick patterns

Bullish

patterns may form after a market downtrend, and signal a reversal of price

movement. They are an indicator for traders to consider opening a long position

to profit from any upward trajectory.

Hammer

The

hammer candlestick pattern is formed of a short body with a long lower wick,

and is found at the bottom of a downward trend. A hammer shows that

although there were selling pressures during the day, ultimately a strong

buying pressure drove the price back up. The color of the body can vary but

green hammers indicate a stronger bull market then red hammers.

It

formed like –

Inverse

hammer

A

similarly bullish pattern is the inverted hammer, the only difference being

that the upper wick is long, while the lower wick is short.

It indicates a buying pressure,

followed by a selling pressure that was not strong enough to drive the market

price down. The inverse hammer suggests that buyer will soon have control of

the market.

It

formed like –

Bullish

engulfing

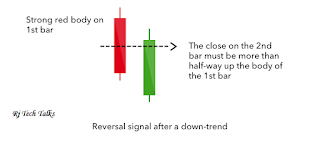

The

bullish engulfing pattern is formed of two candlesticks. The first candle is

short red body that is completely engulfed by a larger green candle.

Though

the second day opens lower than the first, the bullish market pushes the price

up, climaxing in an clear win for buyers.

It

formed like –

Piercing

line

The

piercing line is also a two-stick pattern, made up of a long red candle,

followed by a long green candle.

There

is usually a significant gap down between the first candlesticks closing price,

and the green candlesticks opening. It indicates a strong buying pressure, as

the price is pushed up to or above the mid - price of the previous

day.

It formed like –

Morning

star

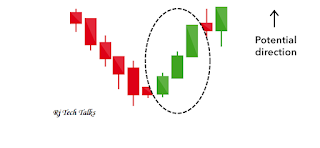

The

morning star candlestick pattern is considered a sign of hope in a bleak market

downtrend. It is a three-stick pattern : one short-bodied candle between a long

red and a long green. Traditionally, the ‘star’ will have no overlap with the

longer bodies, as the market gaps both on open and close.

It signals

that the selling pressure of the first day is subsiding, and a bull market is

on the horizon.

It formed like –

Three

white soldiers

The

three white soldiers pattern occurs over three days. It consists of consecutive

long green candles with small wicks, which open and close progressively higher

then the pervious day.

It is

a very strong bullish signal that occurs after a downtrend and shows a steady

advance of buying pressure.

It

formed like –

No comments:

Post a Comment