What is Candlesticks patterns -

Candlesticks patterns are used to predict the future

direction of price movement. The most 16 common candlesticks patterns and use

of them to identify the opportunities while trading.

What is the candlestick

A candlestick is a way to display the information about an

asset’s price movement. It is one of the most popular components of technical

analysis and to catch the price action on the movement.

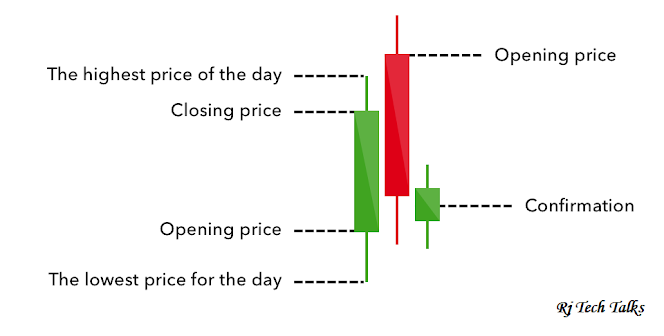

The candlesticks have three basic features :

- The body, which represents the

open-to-close range

- The wick. Or shadow, that

indicates the intraday high and low

- The colour, which reveals the

direction of stock movement basically green body indicates a price

increase and red body shows a price decrease.

Before

you start trading, its important to familiarize yourself with the basics of

candlestick and the only way to understand is “PRACTISE READING CANDLESTICK

PATTERNS”.

The best way to learn to read candlestick patterns is to practice

entering and exiting trades from the signals they give. You can develop your

skills in Demat – trading account, you may open by clicking below:

https://zerodha.com/?c=AY8398&s=CONSOLE

Six bearish candlestick patterns

Bearish

candlestick patterns usually form after an uptrend and signal a point of

resistance. Heavy pessimism about the market price often causes traders to

close their long positions and open a short position to take advantage of the

falling price.

Hanging

man

The

hanging man is the bearish equivalent of hammer : it has the same shape but

forms at the end of an uptrend.

It

indicates that there was a significant sell-off during the day, but that buyers

were able to push the price up again. The large sell – off is often seen as an

indication that the bulls are losing control of the market.

It

formed like –

Shooting

star

The

shooting star is the same shape as the inverted hammer, but is formed in an

uptrend: it has a small lower body, and a long upper wick.

Usually,

the market will gap slightly higher on opening and rally to an intra-day high

before closing at a price just above the open – like a star falling to the

ground.

It

formed like –

Bearish engulfing

A

bearish engulfing pattern occurs at the end of an uptrend. The first candle has

a small green body that is engulfed by a subsequent long red candle.

It

signifies slowdown of price movement and sign of an impending market downturn.

It formed like –

Evening

Star

The

evening star is a three- candlestick pattern that is the equivalent of the

bullish morning star. It is formed of a short candle sandwiched between a long

green candle and a large red candlestick.

It

indicates the reversal of an uptrend and is particularly strong when the third

candlestick erases the gain of the first candle.

It formed like –

Three black crows

The

three black crows candlestick pattern comprises of three consecutive long red

candles with short or non existent wicks. Each session opens at a similar price

to the previous day but selling pressures push the price lower and lower with

each close.

Traders

interpret this pattern as the start of a bearish downtrend as the sellers

have overtaken the buyers during three successive trading days.

It formed like –

Dark cloud cover

The

dark cloud cover candlestick pattern indicates a bearish reversal – a black

cloud over the previous days optimism. It comprises two candlesticks; a red

candlestick which opens above the previous green body and closes below its midpoint.

It

signals that the bears have taken over the session pushing the price sharply

lower. If the wicks of the candles are short it suggests that the downtrend was

extremely critical.

It formed like –

No comments:

Post a Comment